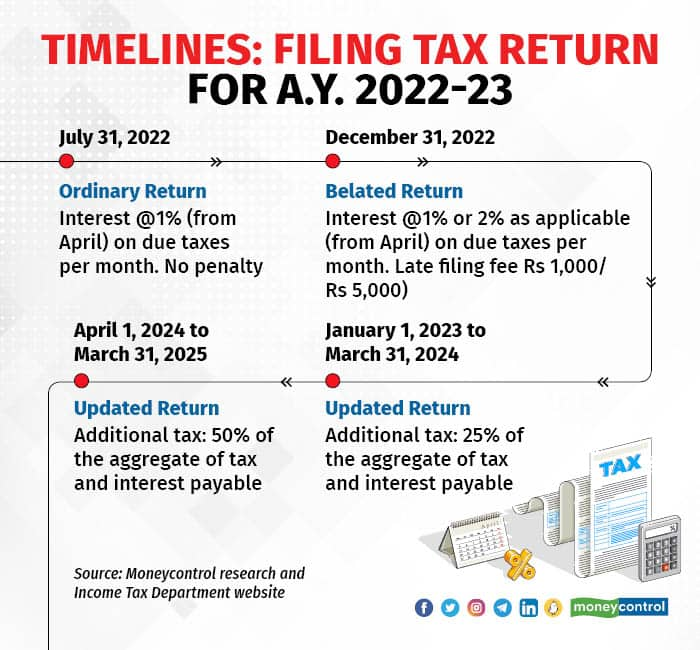

ITR Filing AY 2022-23 Highlights: Without Last Date Extension, more than 5.8 crore ITRs filed till 31 July | The Financial Express

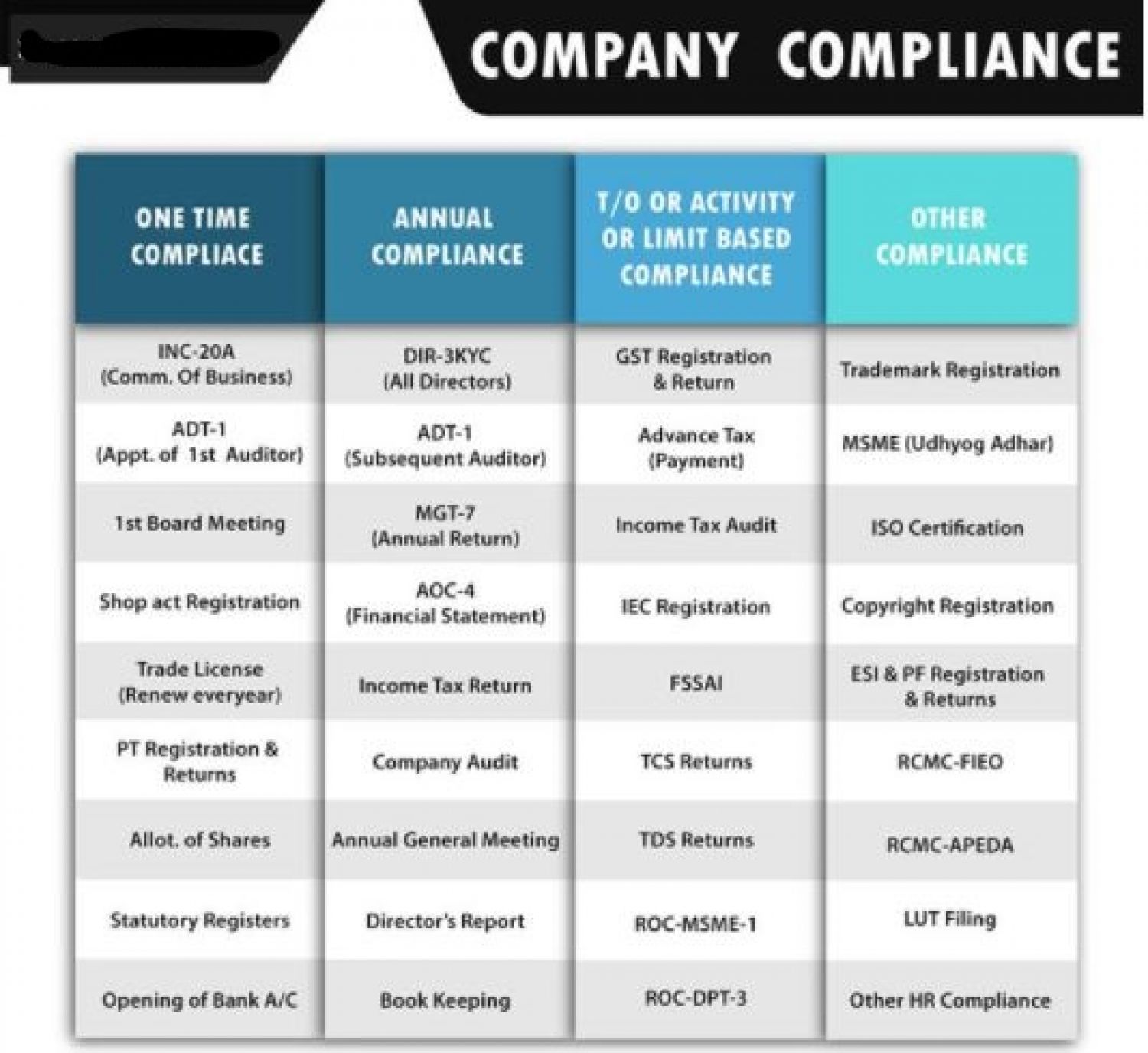

Income Tax Returns (ITR): How to file, e-verify, ITR 1, ITR 2, ITR 3, ITR 4 explained, last date | 91mobiles.com

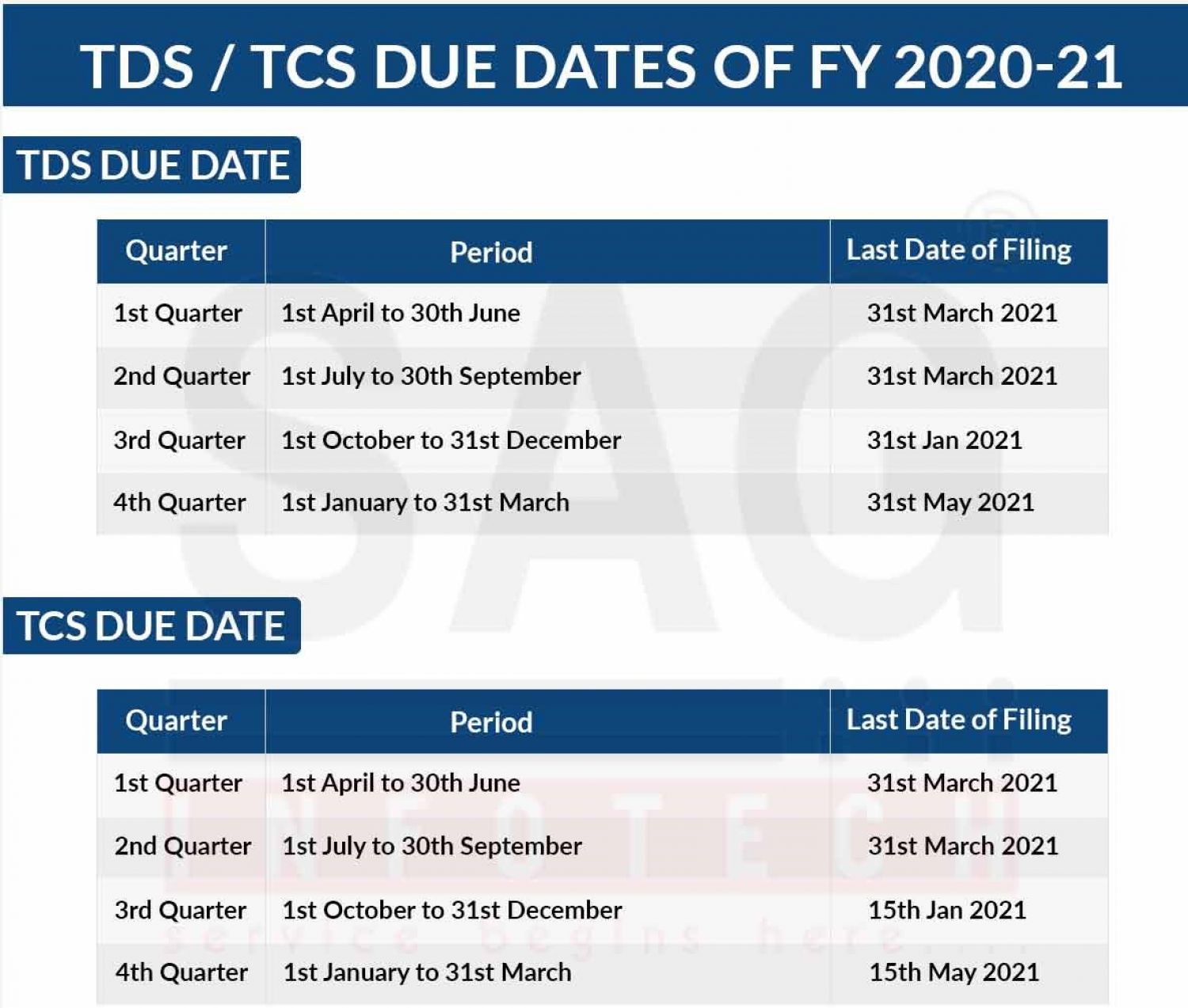

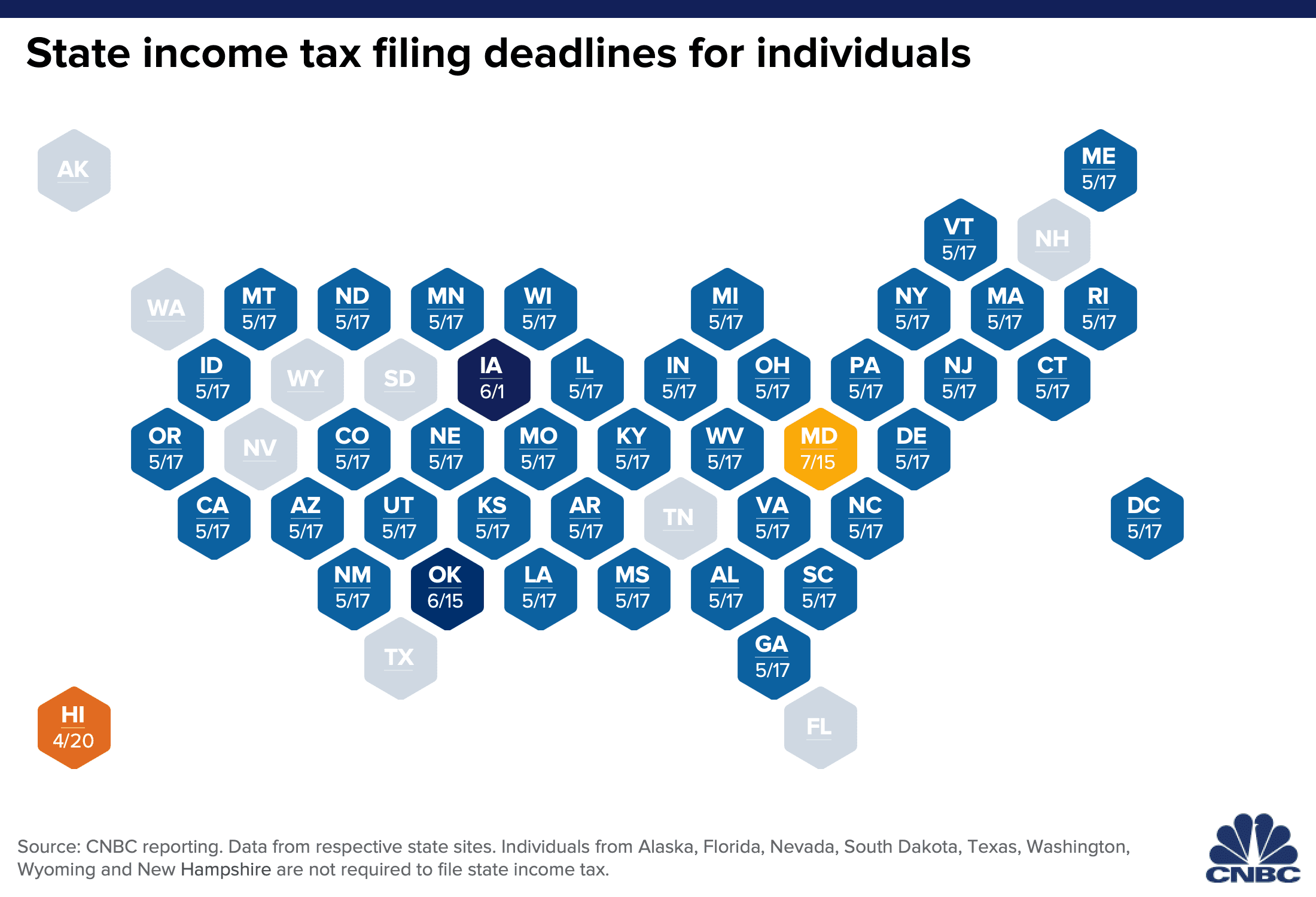

ITR filing last date: Income tax return filing deadline for FY 2020-21 extended to December 31, 2021

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)